Mantra & Co. - Advocate & Tax Consultant

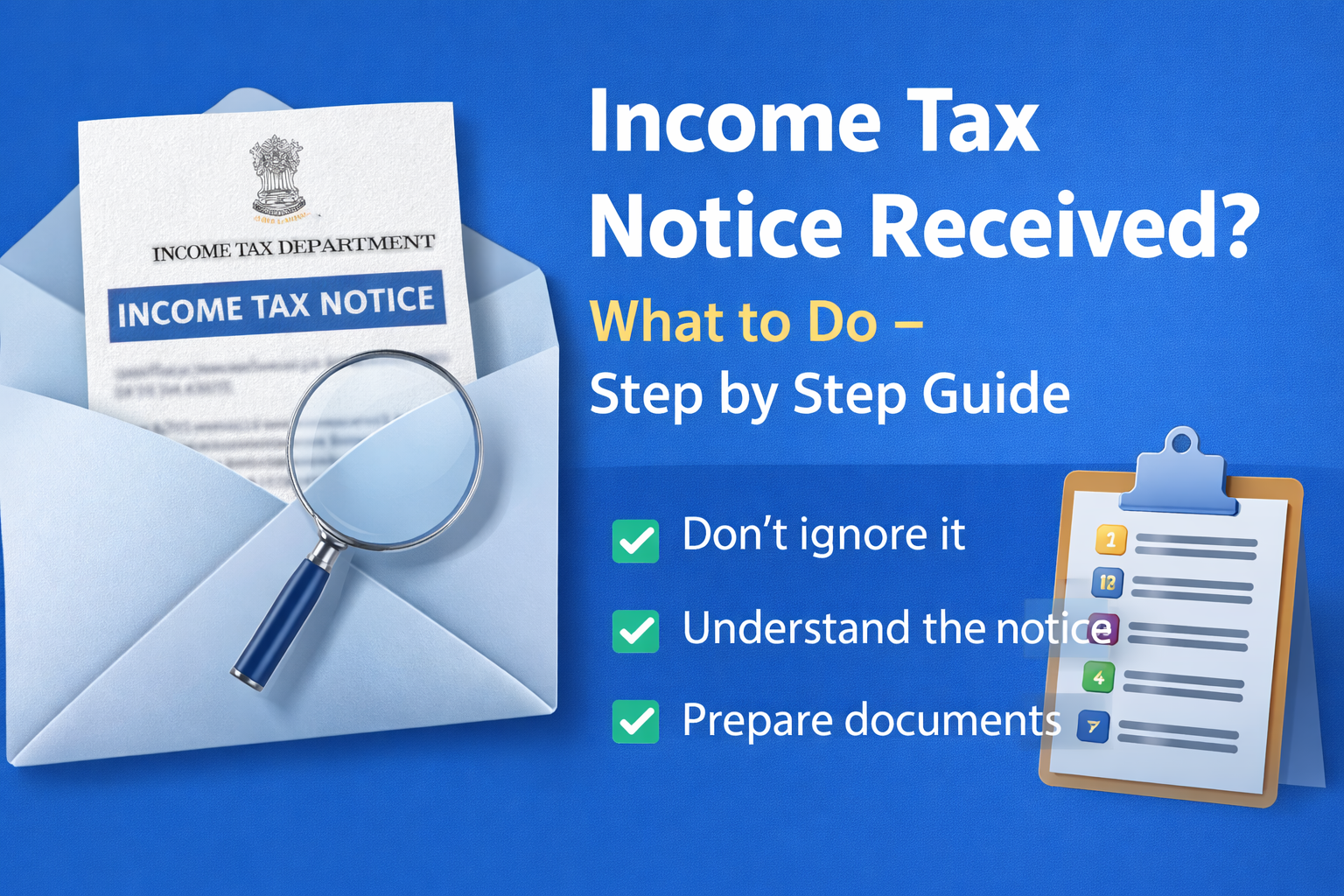

Income Tax Notice Received? What to Do – Step by Step Guide

Received an Income Tax notice? Learn step-by-step what to do, common reasons for notices, and how to respond correctly.

Receiving an Income Tax notice can be stressful for taxpayers, especially when the reason is not clearly understood.

In most cases, notices are issued due to data mismatches, procedural lapses, or delayed responses rather than intentional non-compliance.

This article explains what to do after receiving an Income Tax notice and provides a step-by-step approach to handle it correctly and avoid unnecessary complications.

1. Do Not Ignore the Income Tax Notice

The first and most important step after receiving an Income Tax notice is not to ignore it.

Every notice has a response timeline mentioned in it, and failure to respond within the due date may result in penalties, best judgment assessment, or further proceedings.

Even if you believe the notice has been issued by mistake, it must be reviewed and responded to appropriately.

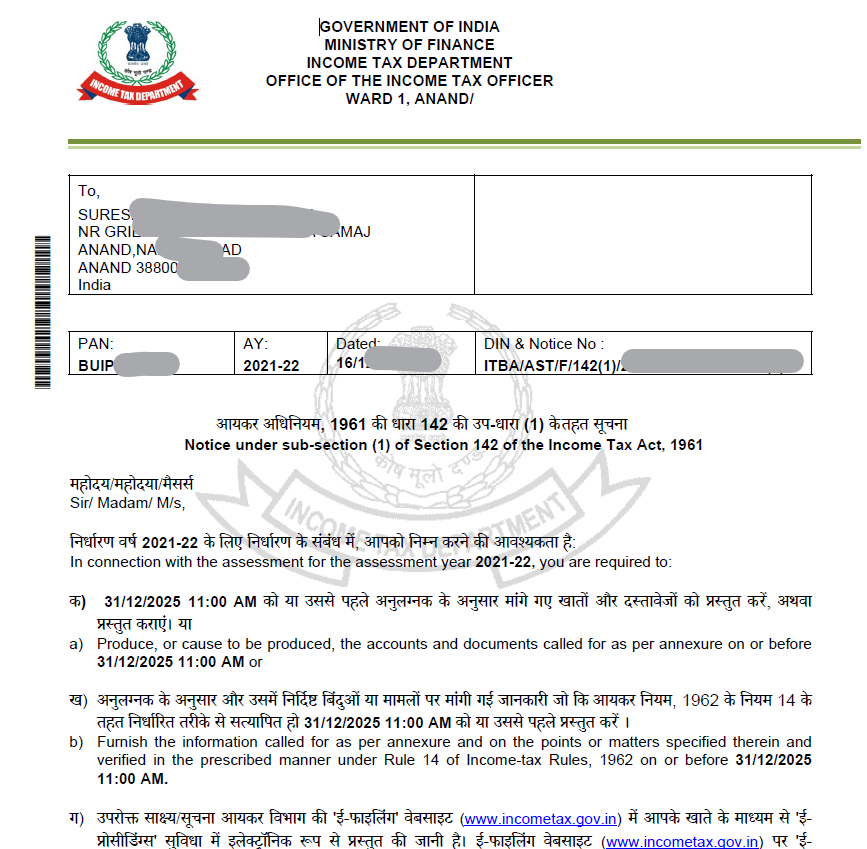

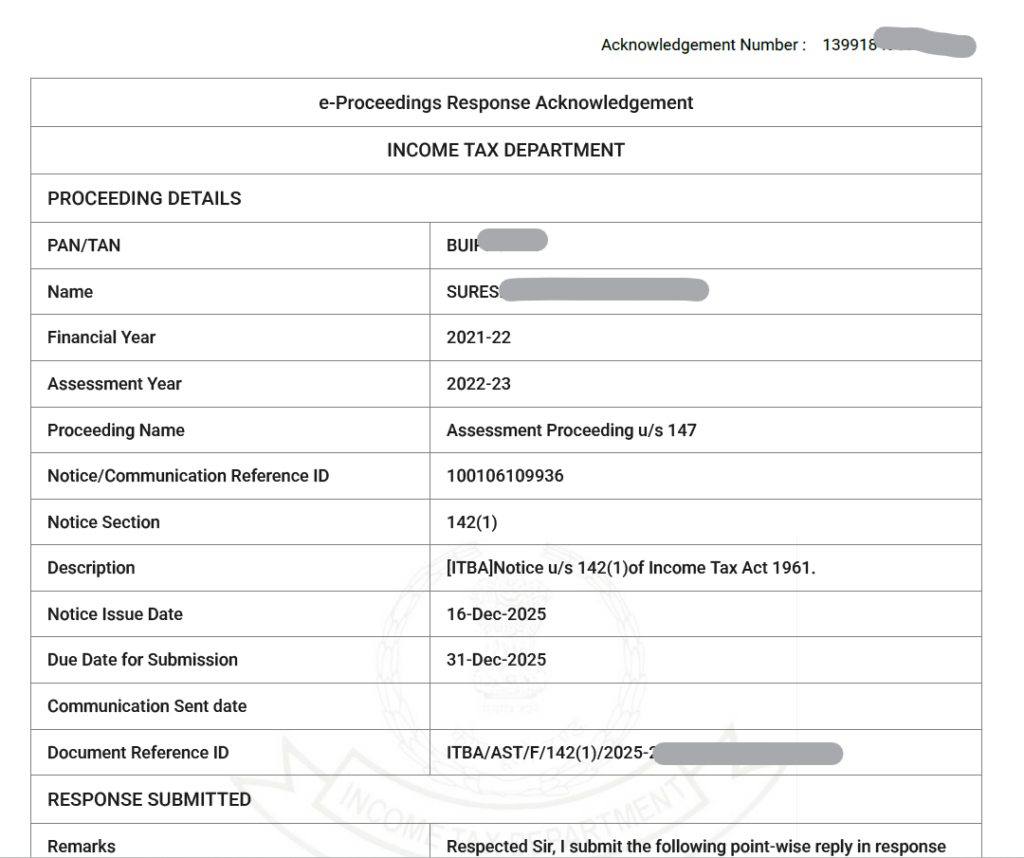

2. Identify the Type and Section of Notice Income Tax notices are issued under different sections of the Income Tax Act, each serving a specific purpose.

Common sections include notices for defective returns, mismatches in income, scrutiny, or reopening of assessments.

Before taking any action, it is essential to carefully check the section under which the notice has been issued, as the response depends on the nature of the notice.

In practice, incorrect or delayed responses often create more issues than the notice itself.

3. Check the Due Date and Mode of Response

Every Income Tax notice specifies a due date for response and the mode through which the response must be submitted.

Most notices now require online response through the Income Tax portal, while some may only seek clarification or confirmation.

Missing the due date or responding through an incorrect mode may lead to adverse consequences, even if the explanation is otherwise correct.

Key Point:

Always note the due date immediately and plan the response well in advance.

4. Understand the Reason Mentioned in the Notice

Income Tax notices are issued for specific reasons such as mismatches in income, defective returns, non-reporting of transactions, or verification requirements.

Carefully read the notice to understand what information or clarification is being sought, rather than assuming it is an allegation of tax evasion.

In many cases, the issue is procedural and can be addressed with proper documentation.

5. Collect Relevant Documents Before Responding

Before submitting any response, it is important to gather all relevant documents supporting the information declared in the return.

These may include income proofs, bank statements, computation sheets, Form 16, Form 26AS, AIS details, or transaction records.

Submitting incomplete or incorrect documents may complicate the matter further.

Practical Tip:

A well-documented response is more effective than a hurried explanation.

6. Respond Carefully and Avoid Incorrect Admissions

While responding to an Income Tax notice, taxpayers should avoid making incorrect admissions or assumptions.

The response should be factual, supported by records, and limited to the scope of the notice.

Providing unnecessary information or speculative explanations may create further issues.

7. Seek Professional Review Where Required

Certain Income Tax notices involve technical interpretation, multiple years, or significant tax impact.

In such cases, it is advisable to have the matter reviewed professionally to ensure accuracy and compliance.

Timely and correct handling at the initial stage often prevents prolonged proceedings.

Conclusion

Receiving an Income Tax notice does not necessarily indicate wrong doing.

Most notices are issued due to data mismatches or procedural gaps and can be resolved with timely and appropriate response.

Understanding the notice, maintaining proper documentation, and following a structured response process are key to avoiding unnecessary complications.

Disclaimer: This article is for informational purposes only and does not constitute legal or tax advice. The views expressed are based on the current understanding of law and portal functionality as on the date of publication. Readers are advised to seek professional advice before taking any action.

If you have any general query or wish to understand the subject better, you may share your question in the comments below.

For insights into GST compliance issues arising from portal automation, you may also read our article on GST compliance updates and portal-driven changes.